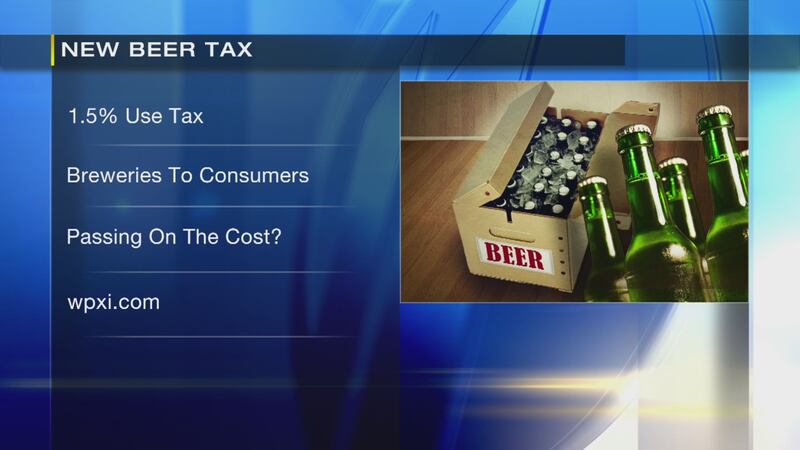

HARRISBURG, Pa. — Customers at Pennsylvania breweries might have to start paying more for their favorite beer starting Tuesday.

Breweries are now required under Act 13 of 2019 to pay use tax on all malt or brewed beverages sold directly to consumers.

The tax is on 25 percent of the retail price of malt or brewed beverages, including purchases made for on-premises consumption and to-go.

You can customize your WPXI News App to receive alerts to news. CLICK HERE to find out how.

In Allegheny County, where sales tax is 7 percent, the use tax ends up being 1.75 percent.

The Pennsylvania Department of Revenue gave the following example on its website:

“Here’s an example with a $5 pint: 25% of $5 is $1.25. That means the manufacturer pays the 6% Pennsylvania use tax on $1.25, which is equal to 7.5 cents. In Allegheny County, the use tax is 7%, which is equal to 8.8 cents. In Philadelphia County, the use tax is 8%, which is equal to 10 cents.”

Breweries could decide to pass the added cost onto consumers.

TRENDING NOW:

- Pittsburgh to Cleveland in 9 minutes? There is new funding to study the possible Hyperloop route

- Introducing Pittsburgh's 2019 Best Places to Work

- Police investigating smash-and-grabs from over a dozen cars

- VIDEO: More cases of people falling ill with EEE nationwide

- DOWNLOAD the Channel 11 News app for breaking news alerts

Cox Media Group